Facing the financial facts of retirement

Larry and I recently had a personal consult with a Utah Retirement System representative to see if we are on track for our retirement plans. I honestly had no idea what he would say. I’ve been merrily going along with my retirement lifestyle planning while putting money in a retirement account, but with no idea whatsoever if the two were in sync. It was time to face the financial facts of retirement.

I grew up in a home where money was constantly “an issue.” We always had food on the table and a roof over our heads, though at times we relied on the church storehouse to make that happen. Each year, I had a new outfit to start school and gifts for my birthday and Christmas, but eating out or going to the movie was a rare treat, and a vacation, beyond driving to Idaho to visit relatives (where we slept in sleeping bags on their kitchen floor), was unheard of. And there was no emergency fund. If the car broke down or some other unexpected expense popped up, there was much hand-wringing and pacing, maybe even arguing and tears, until the money could be scraped together or borrowed. I don’t recall being unduly frightened about this, but I was very much aware.

Some good things came from this upbringing:

- I appreciated everything I received and took great joy in small treats and pleasures that most of my friends took for granted.

- I learned to work for what I wanted. As soon as I was old enough to babysit, I earned my own money for anything beyond the bare necessities, and once I moved out of my parent’s home, I certainly didn’t expect to be rescued or bailed out of any sticky situations. If I was going to make it financially, I was going to have to make it on my own.

- When I was starting out as a young adult, and money was tight, I wasn’t surprised and didn’t feel sorry for myself. This was normal. You juggled bills, you cut back on the non-essentials, you figured it out.

- When I started to earn more and I could pay all of the bills before the due date and even had some money for modest vacations and other little luxuries, I felt wealthy. I didn’t need the fanciest car or designer clothes to feel like I was in Fat City.

- And I recognized the importance of saving—saving for day-to-day emergencies, but also for retirement.

My upbringing also created some challenges:

- I learned nothing about financial planning. While I understood the need for saving, the extent of my plan was to put away as much as possible, cross my fingers, and hope it was enough!

- I have a somewhat schizophrenic relationship with money. I am fearful of making large purchases; even reasonable debt is uncomfortable. But when it comes to the smaller cash purchases, I don’t want to concern myself with prices at all. I want to buy whatever makes me happy. Again, with no real sense of whether I’m spending wisely or not. I suspect my subconscious is rebelling against the constant price checking and bargain shopping of my youth.

So when it came time to face the financial facts of my retirement “planning,” I had no idea what to expect. I was pleasantly surprised. It turns out putting the maximum allowed by law in a 401(k) or 457 for the past 20 years and letting the administrator manage the funds based on my risk tolerance and anticipated retirement date worked. Given the facts as they are today, we should be in comfortable shape. Of course, I have no idea what the future holds, and life has a way of turning things upside down, but we can only do the best that we can with what we know today and then leave it in the hands of the Universe (or God or fate—insert whatever power you believe).

It doesn’t hurt that I have the benefit of a pension plan, something that has become rare in the United States. My recommendation to those of you who are at the beginning of your careers, if you have the opportunity to meet with a retirement specialist now, do it. You can save yourself a lot of uncertainty and possible retirement challenges by making well-informed decisions now. Sometimes the cross-your-fingers-and-go approach works out, but why count on that when you can make well-informed decisions?

And, of course, in order to save for retirement, you have to manage your current finances. I had a little help in that area a couple of years ago (again quite late in the game) when my employer offered the 8 Pillars of Financial Greatness course. You can purchase the book for self-study, or try one of the many other respected resources out there, but do something to get a handle on your financial wellbeing for now and in the future.

Money may not buy happiness, but a lack of it can lead to unnecessary suffering, and having some money to spare allows you the opportunity to participate in experiences that may not otherwise be available to you.

8-week transformation challenge update

In order to create accountability for myself, I will be giving a weekly update of my efforts and progress in the 8-week Transformation Challenge. If you are not interested in this portion of my blog, please feel free to skip down to “Your Turn.” I’d love to hear from you.

Workouts

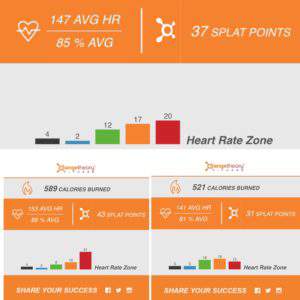

I attended three Orangetheory classes this week.

In between the Orangetheory workouts, I did one yoga session, one ride on the stationary bike, and two rest days. I had planned to run Sunday, but decided to go to sangha with my daughter instead. (I do not regret that decision.)

Nutrition

I completed one week of clean eating from the time I got up until dinner, with a more relaxed approach to the evenings. That seemed to work for me. I enjoyed the food, had more energy, and lost weight. If you are wondering what I mean by clean eating, it’s a focus on (in this order) non-starchy vegetables; high protein foods; fruits, starchy vegetables, grains, and beans; and healthy fats. I avoid sugar, alcohol, processed foods, and most dairy during the day. (I did have a frosted sugar cookie on Valentine’s Day.)

Weigh-in

I lost 1.8 pounds this week, for a total of 3 pounds so far, which goes to show you don’t have to be perfect to make progress. I skipped one exercise session, ate one daytime cookie, and had dessert each night.

Your turn

- Do you have any recommendations for financial planning resources?

- For those of you currently employed, do you have an active retirement plan?

- For those of you who are retired, at what age did you start saving for retirement? Was it enough, or would you have done something different?

- What is your best piece of financial planning advice?

Hi Christie,

The Wealthy Barber Returns by Dave Chilton is both helpful and hilariously funny. It’s Canadian to meet the needs of your non-401K readers.

I started saving for retirement in my late 20’s and I retired three years ago at age 55. I think ‘enough’ is a state of mind rather than bank account. Some days I have enough, some days more than enough, and some days not enough.

My best piece of financial advice is to decide what’s important in your life and make financial decisions in accordance with that. Then that mental state of ‘enough’ will be easier to come by.

Thank you for the great advice, Karen, and for the suggested read. It is so true that what is enough for one person would not be for another and even that enough changes over time for the same person.

This was a very enjoyable read, and in particular I can appreciate the view of money you have via your upbringing — not an understated dynamic given that most of us approach spending/saving from how we viewed it in our formative years.

It’s a shame that the traditional pension has for the most part died on the vine in the private sector. This in turn has put the responsibility to save on those who are either uninterested or unprepared. Good for you for taking control of your own financial destiny.

Welcome Marty and thanks for joining in the discussion. I feel blessed to have a pension. I worry for my adult children and fear that I did not teach them enough about saving and financial planning. I would be interested to hear what they remember about finances from their childhood. That sounds like a good topic for our next discussion.

Your childhood sounds so much like my own and it taught me most of the lessons yours did. I never gave much thought to retirement until I decided to retire. By the grace of God, it all worked out. I have a state retirement and a small social security check and husband has the same. We are just in year two and are facing my husbands’ illness but still feel very good about our funds.

Thanks for sharing your thoughts, Victoria. I wish all the best for you and your husband. Life doesn’t always go along with our plans, and other times we seem to be taken care of despite our lack of planning. I hope you have much to smile about today.

Well done, Christie, on your retirement planning and the 8-week transformation challenge! My financial advice to my family members is to start saving as soon as they earn an income, even a small amount each month or each pay will grow with the magic of compound interest, and more importantly, it’s the habit of saving. It’s not what you earn, it’s what you save, that really helps reach the financial goals sooner. At the same time, reward yourself for your efforts.

Well said Natalie. If you have money taken directly out of your paycheck, you never see it and you don’t miss it. I also agree that you should reward yourself for your efforts, and enjoy yourself along the way.

My background is very similar to yours. I can barely remember a time when i didn’t work and had a thriving babysitting service as 12. I, too stashed away money taken directly from my paychecks. My husband and i took a retirement class and were delighted to find out we are in good shape for retirement. Saving a little bit regularly for a very long time turns out to be a good strategy!

It’s amazing how that works, isn’t it? I never missed the money they were taking, since it came out before I ever saw it, and now I get to benefit from compound interest!

Hi Christie, I grew up in a similar household. We weren’t flush with money but certainly with love and my parents ensured we didn’t really miss out on too much. My husband and I had to start over when we got together. We had both been married before but really had to start from scratch in our 40s. We have a comfortable retirement which affords an overseas holiday each year if we want it. We have both worked hard to get here though and pride ourselves on achieving what we have in 25 years. I always feel inspired when I read your 8 week challenge progress. Thank you for sharing and linking up at Midlife Share the Love Party and see you next week! #MLSTL

I had a similar situation Sue. My husband and I were married 19 years ago (second marriages for both of us) and basically started over at that point as well. That’s when we got serious about preparing for future retirement. As I mentioned, that savings will be supplemented by a pension plan, which helps. I would highly recommend that young people start saving the first day they start earning. Thanks again for hosting the Midlife Share the Love Party.

Although my upbringing wasn’t as tight money-wise as yours, my parents were good savers and lived beneath their means. Although we took regular vacations, they were relatively inexpensive ones – camping mostly – and any hotels were the kind you drove your car up in front of the room. Looking back, I’d compare our camping trips favorably to any Disney-type cruise for memory-making. We had a blast and they instilled in us kids a love of nature we still have.

Because of the way I was raised, I have been a saver all my life. My biggest challenge now that I’m retired and no longer have a paycheck coming in (unfortunately, I didn’t retire with a pension – lucky you!) is feeling comfortable spending money. We are in good shape financially but I also know that stuff can happen. So, my best advice to those who haven’t yet retired is “live beneath your means.” Don’t compare what you have to what others have. It’s not uncommon for others who appear to “have it all” are actually heavily in debt.

Karen recommended the Wealthy Barber books which are good. I would add The Millionaire Next Door and Jane Bryant Quinn’s Making the Most of Your Money as good resources.

So true, Janis, wonderful memories can be made without breaking the bank. Live beneath your means is great advice. That’s the other key to our comfortable retirement position–we have no debt. Thanks for sharing the book recommendations.

We have lived frugally all our married life Christie (I remember being so excited when we had a $1000 float in our savings account!) We are still good savers and hopefully have set ourselves up for retirement down the track. We won’t be rolling in clover but I don’t think we’ll be sleeping under a bridge and eating catfood either! Thanks for sharing on #MLSTL – I’ve shared this on my social media x

It’s all about finding that balance between enjoying today and preparing for the future, so you can enjoy that as well. I think frugal joy now is definitely worth being comfortable in retirement.

Great post 🙂 My best piece of planning advice is always have an eye on the future from an early age. Find out a strategy that works for you, diversify saving schemes and then stick to it.

I agree, Jo, the earlier you start saving the better. And you make a good point about finding a strategy that works for you. There is more than one way to reach the desired destination.

Hi Christie

Well done on your fitness / losing weight goals, and even more on being in good financial shape for retirement.

Like you, I put money away regularly and was also lucky to have a pension plan, so we went into retirement in pretty reasonable financial shape. It makes such a difference to enjoying your retirement

Thanks Erith. I’m glad to hear your planning paid off. That has been one of my fears, that either I wouldn’t be able to retire as soon as I’d like, or that I would retire and the money would run out. While there are no guarantees in life, I was relieved to hear from a professional that we are on the right track.

This is a great post Christie because not many people actually talk openly about the money side of retirement. You have shown how it can work out well if you make the effort during your working life. You should be very proud of your achievements! #mlstl

Thanks Deb. For some reason, even talking about money is tricky. There seems to be shame associated with caring too much about money and shame for not caring (or having) enough. It’s another area in my life where I’ve come to realize it’s not important what other people think. What is important is my own motivation and comfort level with where I’m at and what I’m doing.

Hi Christie,

This has always been a scary subject for me. And after my divorce and working two jobs to send my daughter through college, it became even scarier. My parents never discussed money in front of me. I never wanted for anything I needed, but money was not a topic they discussed…at least in my ear shot. So I had to learn what little I know on my own. My hubs and I had to begin again late but we have made our peace with that and are doing what we can to secure a decent retirement for the both of us.

I agree, Clearissa, money can be an emotionally charged–even scary–subject. Several people have mentioned (myself included) starting over after a divorce and remarriage. It’s a fact of life for many of us. I’m glad you and your husband have made peace with that and are working together for the future.

Funny how we are truly products of our upbringing. My parents were very comfortable financially but we didn’t live extravagantly in the least. As an adult, I have always struggled financially, because I wanted to give my daughters things that my parents could have afforded for us but didn’t. So, I was a hand wringer when the car broke, learned to repair the AC myself, etc., and always looked forward to my tax refund to be able to do something fun or pay off bills.

When I decided to take early retirement for a health issue, I was “okay” with what my retirement but realize that if it weren’t for my husband’s paycheck, I would be back to living paycheck to paycheck again. And apparently, as a Texas teacher, we have to contribute to Texas Retirement Service but by doing so we don’t pay into SS. Then at retirement, we are limited to only a TRS retirement check and not able to draw SS that we paid into through other jobs. Terribly frustrating.

Glad you are going to be in good shape. Retirement is quite the adjustment without compounding things with financial woes.

It really is interesting the lessons we learn–and they aren’t necessarily the ones our parents intended. As you pointed out, many of us don’t know what we are getting into as far as retirement savings until we’re so far down the road, it’s difficult to make the necessary adjustments. Sometimes it works out, and sometimes it doesn’t. And then there’s always that saying about the best laid plans…

Christie, I wish I could have read this when I was twenty. Or thirty.

But anyway, we are where we are and live there happily, so we’ll just work until we can’t.

Great advice for the young!

🙂 gwingal

There was probably someone trying to tell me about retirement planning when I was in my 20s and early 30s, but I wasn’t listening. My 60s seemed so far away at that time, and I had children to feed and a mortgage to pay.

yep. me too.

Christie, I think I learned some pretty good financial lessons from my parents: live below your means and quality over quantity. I remember times in my tween and teen years going shopping with my parents for something I needed (bicycle, typewriter, etc) and trying to be “polite” by choosing a lesser version of whatever it was. Then my dad would say, Let’s think about it; then go over the pros and cons of both it and the more expensive one. I’d end up going home with the best one! But the lesson was not “You have to have the best,” but rather “Buy the best that you can afford so that it will last and serve you well.”

What a great life lesson. It’s so important to weigh out your options and make mindful choices. This is true in our finances, our food choices, our investment of time and energy–pretty much everything. Thanks Jean for sharing this important lesson from your parents. They sound pretty great.

20 minutes in the red zone? That’s crazy! 😉 I go to Orange Theory too. Good job. Early in our marriage we took a money course at our church, got out of debt and started saving. But I never really paid that much attention to “retirement planning” per se. My husband handled that. We are close to retirement and are fine. But I am pleased that my married daughter and her husband (both 29) have been seeing a financial planner together.

Yeah, 20 minutes in the red is probably not the goal. That was a tough workout. I didn’t know you were a fellow Orangetheory enthusiast. I really like it. That’s great that your church offered money management courses. I think it’s an aspect of our lives that doesn’t get enough attention. Good for your daughter and her husband for starting early.